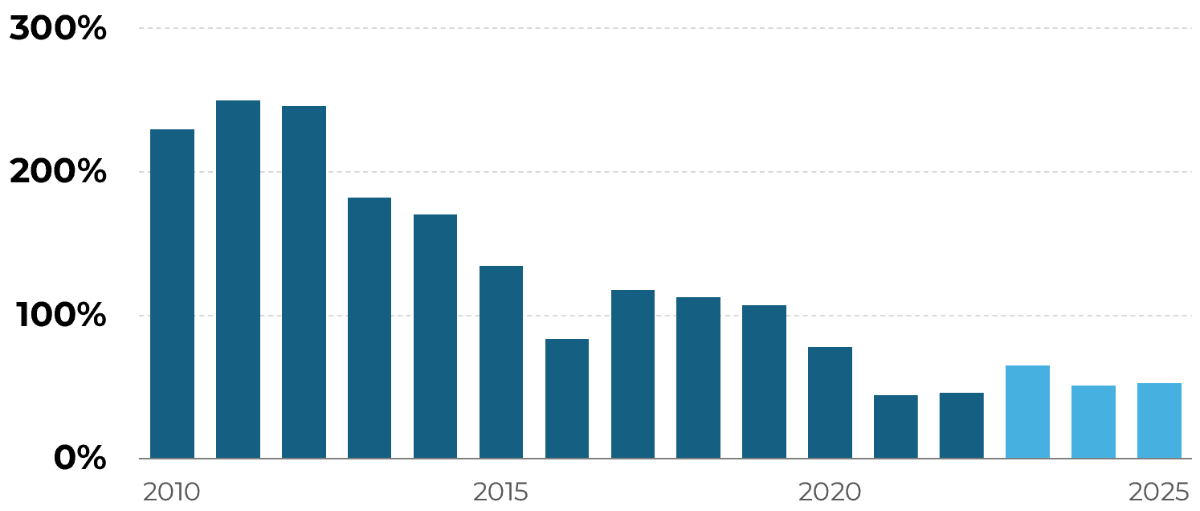

Oil Execs Holding the Line on Spending

Oil company reinvestment rate

percentage of cash flow from operations

It’s a story as old as time: the oil industry booms and spends money like an 8-year-old in the candy story on allowance day, then a bust inevitably follows and spending dries up. At least, that was the story for decades. This time, it really might be different.

Background: Historically, oil and gas producers funded production growth with money from new investors, which worked great until it didn’t.

In the early 2010s, shale oil and shale gas changed the game. Cheap and plentiful supplies of both cratered prices, forcing companies to start a secular trend of spending less each year. At least as a percent of cash flows.

- Things got so crazy that many companies actually started spending less than they generated in any given year – gasp. In other words, the reinvestment rate fell below 100 percent.

The trend has continued. Despite relatively strong prices and tight supply, companies are maintaining “capital discipline” and the reinvestment rate has remained below 100 percent, even in the shale oil sector.

Zoom out: There are signs that purse strings are loosening, though most doubt that we will ever see the oil investment boom of the late 2000 and early 2010s again. But when you have change in your pocket and the candy store is right there, who knows how long you can hold out.