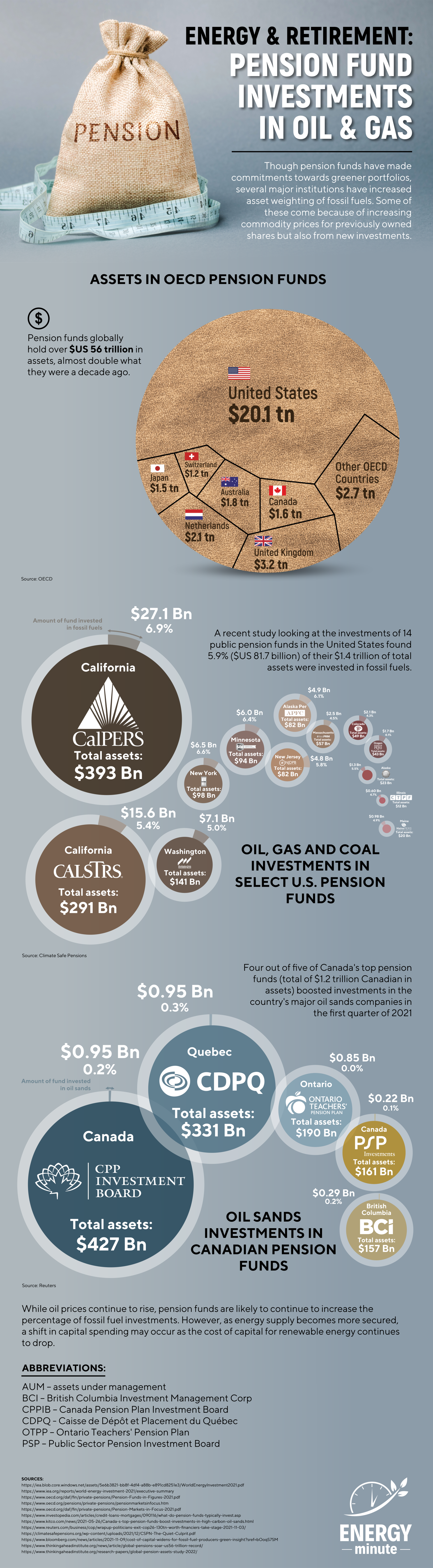

Energy and Retirement: Pension Fund Investments in Oil and Gas

Retirement funds are moving away from fossil fuels due to growing concerns about the impact of climate change and the financial risks associated with investments in the fossil fuel industry.

There are several ways retirement funds are divesting from fossil fuels. One approach is to sell off investments in companies that are primarily involved in the extraction, production, and distribution of fossil fuels such as coal, oil, and gas. This is known as fossil fuel divestment. Another approach is to invest in companies that are focused on clean energy and are not involved in fossil fuel production.

The main reasons why retirement funds are divesting from fossil fuels are:

- Climate Risk: There is growing awareness that climate change poses a significant risk to the global economy and the financial system. Many retirement funds have recognized the potential financial risks associated with investments in fossil fuels, including the risk of stranded assets, which are assets that may lose value due to changes in regulations, technology, or market demand.

- Environmental and Social Concerns: Fossil fuel extraction and production have significant environmental and social impacts, including air and water pollution, habitat destruction, and human rights violations. Many retirement funds have recognized the importance of investing in companies that prioritize environmental and social sustainability.

- Economic Viability of Clean Energy: The declining cost of renewable energy technologies such as solar and wind power has made clean energy more competitive with fossil fuels. As a result, many retirement funds are shifting their investments to renewable energy companies, which are seen as having better long-term growth prospects.

While oil prices continue to rise, pension funds are likely to continue to increase the percentage of fossil fuel investments. However, as energy supply becomes more secured, a shift in capital spending may occur as the cost of capital for renewable energy continues to drop.

Sources:

https://www.iea.org/reports/world-energy-investment-2021/executive-summary

https://www.oecd.org/daf/fin/private-pensions/Pension-Funds-in-Figures-2021.pdf

https://www.oecd.org/pensions/private-pensions/pensionmarketsinfocus.htm

https://www.oecd.org/daf/fin/private-pensions/Pension-Markets-in-Focus-2021.pdf

https://climatesafepensions.org/wp-content/uploads/2021/12/CSPN-The-Quiet-Culprit.pdf