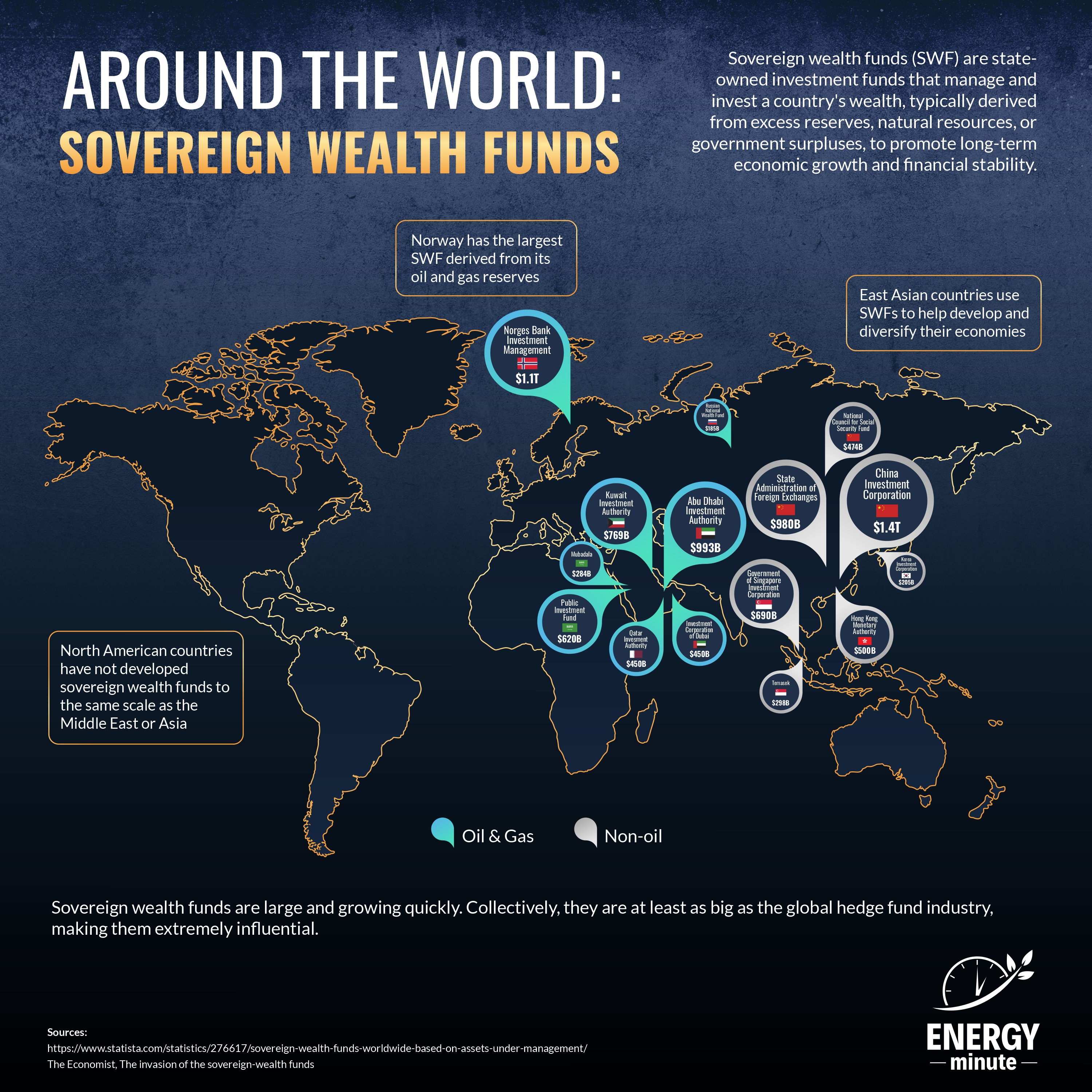

The Rise of Sovereign Wealth Funds

History of Sovereign Wealth Funds

Sovereign wealth funds (SWFs) have a long history, but their modern incarnation emerged in the mid-20th century. The first sovereign wealth fund can be traced back to the Kuwait Investment Authority (KIA), established in 1953. The KIA was created to manage Kuwait’s surplus oil revenues and invest them for future generations.

Following the establishment of the KIA, other countries began to create their own sovereign wealth funds. Notable early examples include:

- Norges Bank Investment Management (established in 1967): Initially, the fund was created to manage Norway’s oil revenues. It has since become one of the largest and most well-known sovereign wealth funds globally, known for its focus on long-term investing and transparency.

- Abu Dhabi Investment Authority (established in 1976): Formed by the Emirate of Abu Dhabi in the United Arab Emirates, this fund manages the surplus oil revenues of the emirate. It is one of the largest sovereign wealth funds in the world.

- Singapore’s GIC Private Limited (established in 1981): The Government of Singapore Investment Corporation (GIC) was created to manage Singapore’s foreign reserves and achieve long-term investment returns.

These early sovereign wealth funds paved the way for the proliferation of SWFs globally, with countries such as China, Qatar, Saudi Arabia, and many others establishing their own funds in subsequent years.

About Sovereign Wealth Funds

Sovereign wealth funds (SWFs) are state-owned investment funds that hold and manage significant financial assets. They are typically established by countries with substantial reserves of foreign currency or natural resources. Here are some key points to know about sovereign wealth funds:

- Purpose: The primary objective of SWFs is to generate investment returns and preserve wealth for future generations or strategic purposes. They aim to diversify a country’s revenue streams, stabilize the economy, or fund specific national projects.

- Ownership and Structure: Sovereign wealth funds are owned and controlled by governments. They can be established at the national or subnational level and may operate independently or under the supervision of a government ministry or entity.

- Funding Sources: SWFs receive their capital from various sources, such as government budget surpluses, trade surpluses, commodity exports (e.g., oil, gas, minerals), privatization proceeds, or foreign exchange reserves.

- Investment Strategies: Sovereign wealth funds employ different investment strategies based on their specific mandates. Common investment approaches include diversified portfolios across asset classes (stocks, bonds, real estate, private equity), direct investments in companies or infrastructure projects, and participation in public markets.

- Size and Global Impact: SWFs have grown significantly in recent years, with some funds amassing more than a trillion dollars in assets. They have the potential to exert substantial influence on financial markets, industries, and economies due to their significant investment power.

- Long-Term Investment Horizon: Unlike many private investment funds, SWFs typically have a long-term investment horizon. Their purpose is to generate returns over decades or even generations, enabling them to make patient investments that align with their strategic objectives.

- Transparency and Governance: The level of transparency and governance varies among sovereign wealth funds. Some funds prioritize transparency, regularly disclosing their holdings, investment strategies, and financial performance. Others may have more limited transparency, citing strategic or national security reasons.

- Economic Development and Diversification: Sovereign wealth funds often play a role in economic development by supporting domestic industries, infrastructure projects, and technological advancements. They can help diversify a country’s revenue sources away from reliance on finite resources.

- Global Investment Partnerships: SWFs frequently engage in international collaborations and partnerships, forming alliances with other funds, governments, or private sector entities to pursue joint investment opportunities and share expertise.

Political Considerations: Sovereign wealth funds can be subject to political considerations, reflecting their government ownership. They may prioritize national strategic objectives, promote domestic industries, or support diplomatic efforts, which can impact their investment decisions.

Sources

https://www.statista.com/statistics/276617/sovereign-wealth-funds-worldwide-based-on-assets-under-

management/

https://www.economist.com/leaders/2008/01/17/the-invasion-of-the-sovereign-wealth-funds