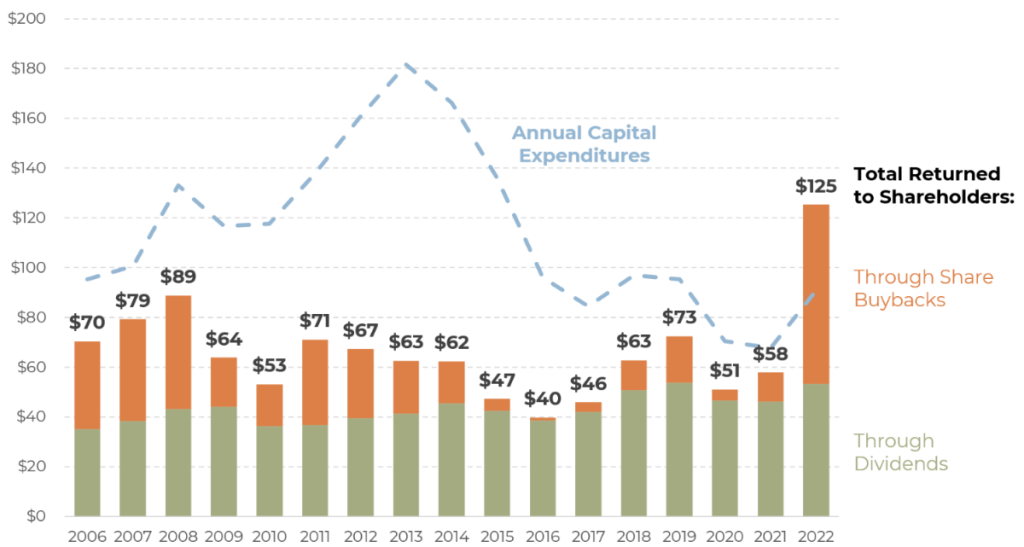

Oil & Gas Shareholders Set Share Buyback Records

Total supermajor dividends, buybacks and capital expenditures

USD in billions

It’s been a tough 12 months for energy consumers looking for places to lay blame. You can only talk about Putin for so long, so the focus has turned to a favorite punching bag: the biggest of the public oil and gas companies, the “supermajors”.

The eye (and ire) of Biden: Part of last year’s Inflation Reduction Act included provisions to tax corporate share buybacks from US companies at a rate of 1 percent. The Biden Administration is now looking to quadruple that to 4 percent, partially to penalize supermajors that buy back shares instead of investing in increased oil and gas production.

- Share buybacks, along with their sleepier cousin dividends, are ways that companies that don’t see appealing investments can still return excess cash to company owners.

2022: The year of the buyback

Last year, the six supermajors returned $125 billion to shareholders while only investing $91 billion to increase production. This is the first time in 15+ years where companies have paid out more than they invested in production growth.

Zoom out: It isn’t as simple as greedy oil barons. The oil and gas industry has been told it has one foot in the grave for over a decade, pressuring existing shareholders to look for returns now instead of growth in the future. So it’s unsurprising that managers are opting to return money rather than investing it.

We will see if a buyback tax has any impact. Spoiler: it probably won’t.