The Difficult Choice Facing Bankers

The should-they-or-shouldn’t-they debate about finance owning environmental issues continued on Wednesday, as three of the largest asset managers made headlines.

Background: Moving from a world of activism to action requires money, lots of it. The IEA estimates to reach net zero by 2050, clean energy investment will need to triple to $4 trillion annually by the end of the decade. So as demand for investments heat up, there is mounting pressure on large asset managers to shift money into clean investments.

Yesterday’s headlines

BlackRock: UK-based activist investor Bluebell Capital Partners called on the founder and CEO of BlackRock, Larry Fink, to resign. Bluebell, with its 0.01 percent stake in the largest asset manager in the world, said the company’s use of environmental, social, and governance (ESG) factors was filled with “hypocrisy” when looking at its investments.

BlackRock still holds significant thermal coal assets despite pledging to sell them more than two years ago.

- Bluebell has had success with its shareholder activism before. Last year, the company successful ousted Danone Chairman Emmanuel Faber and the CEO of Hugo Boss the year before that.

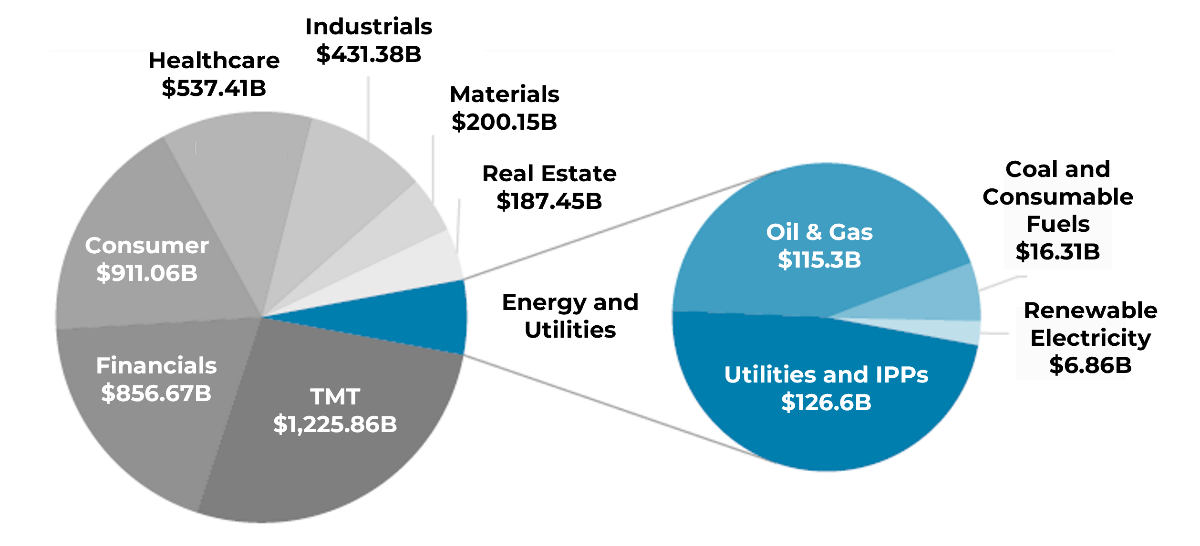

BlackRock’s investments by sector

share of market value as of February 2021, USD

Vanguard: The second largest asset manager (behind BlackRock) announced it was pulling out of the Net Zero Asset Manager initiative. The company cited investor ‘confusion’ coming during a time of increased ESG criticisms from Republicans.

- Last month, Republican attorneys-general asked the Federal Energy Regulatory Commission not to renew Vanguard’s ability to buy shares in American utilities.

Also taking heat from the other side, an official from the Sierra Group said Vanguard “had never been serious” about mitigating climate change.

Norway’s sovereign wealth fund: Nicolai Tangen, CEO of the $1.3 trillion Norwegian oil fund, issued a warning saying it would “absolutely” vote against companies without a target to reach net-zero emissions.

- According to the CEO, only 10 percent of companies owned by the firm have a net-zero target in place, though that amount accounts for one third of the fund’s emissions.

Tangen also targeted excessive executive pay in the US, saying “executive pay and corporate greed has just reached a level that is really unhealthy”.

Zoom out: Activism about addressing climate change shifting from the streets to the boardroom is a sign the energy transition is progressing. Now bankers will be earning their big pay cheques in the coming years navigating complex trillion-dollar decisions.