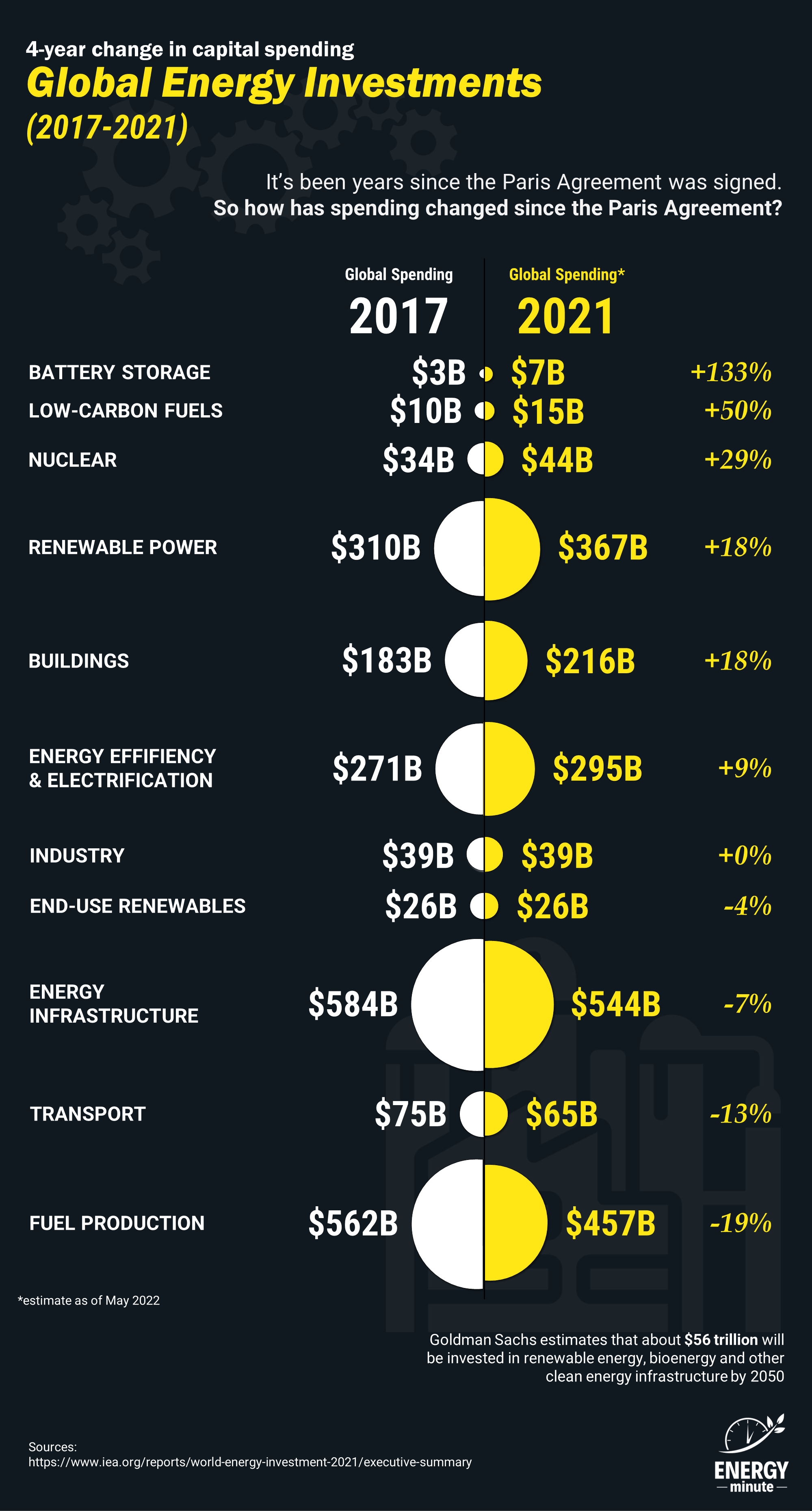

4-Year Change in Capital Spending: Global Energy Investments

It’s been years since the Paris Agreement was signed. So how has spending changed since the Paris Agreement?

Governments, companies and investors have increased their pledges to drastically reduce greenhouse gas (GHG) emissions but in times of instability, country to country conflicts and concerns for security of energy supplies, the concern for security has historically won out over environmental sustainability.

Energy investments have improved with economic growth, more than offsetting the 4% contraction experienced in 2020.

Global Energy Investment

Of the $US 1.9 trillion the IEA estimated to be invested in energy in 2021, only US$750 billion was targeted for clean energy technologies.

Global Investment in Clean Energy and Energy Efficiency (2017 – 2021e)

At COP 26, finance firms managing $130 trillion in assets joined the net-zero pledge aimed at combating climate change so where is the money coming from to support the rising demand for energy, in particular, fossil fuels?

Pension funds globally hold over $US 56 trillion in assets, almost double what they were a decade ago. Pension fund assets are managed with the intent of ensuring that eligible retirees receive the benefits promised to them.

Of note, pension assets have increased faster than gross domestic product (GDP) over the last decade underpinning the growing importance of retirement savings worldwide.

Though pension funds have indicated commitments towards greener portfolios, a number of the major institutions have increased investments in fossil fuels, some as a result of rising prices for already owned shares but also some from new purchases.

Looking forward

Goldman Sachs estimates that about $56 trillion will be invested in renewable energy, bioenergy and other clean energy infrastructure by 2050.

Sources:

https://www.iea.org/reports/world-energy-investment-2021/executive-summary